Evolutionarily speaking, we are wired to seek immediate rewards. This is because our ancestors lived in environments where resource

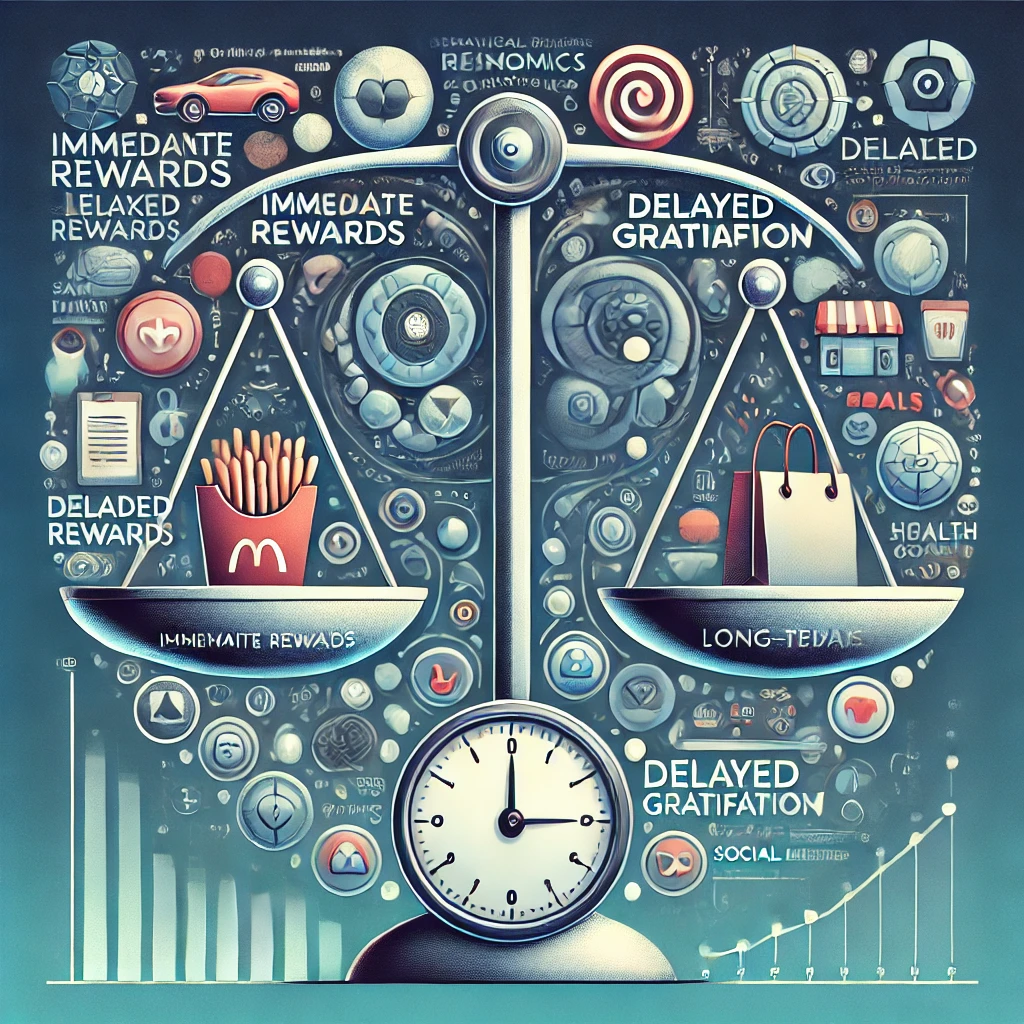

s were scarce and unpredictable. As a result, they evolved to prefer immediate rewards over delayed rewards, as this strategy helped them to survive and reproduce.

However, in today’s world, our tendency to prefer immediate rewards can sometimes lead us to make poor decisions. For example, we might overspend on impulse purchases, eat unhealthy foods, or procrastinate on important tasks.

Behavioral economics is a field that examines how people make decisions in real-world settings. Behavioral economists have identified several ways to use our understanding of human psychology to design incentives and policies that can help us make better choices.

Here are a few examples:

- Provide immediate rewards for desired behaviors. For example, some health insurance companies offer discounts to members who complete preventive care screenings, such as mammograms and colonoscopies. This provides an immediate incentive for people to take care of their health.

- Make delayed rewards more attractive. For example, some companies offer matching contributions to their employees’ retirement savings plans. This means the company will match a certain percentage of the employee’s contributions up to a certain limit. This makes retirement savings more attractive, even though the benefits are not immediate.

- Use social norms to influence behavior. For example, some energy companies send their customers personalized reports that compare their energy usage to that of their neighbors. This can help motivate people to reduce their energy consumption and conform to social norms.

These are just a few examples of how behavioral economics can help us overcome our evolutionary biases and make better choices. By understanding how our minds work, we can design incentives and policies that can help us achieve our goals.

Here are some additional thoughts on how we might be able to use behavioral economics to promote healthier lifestyles and savings:

- Healthier lifestyles:

- Make healthy food options more convenient and affordable. For example, grocery stores could offer discounts on fruits and vegetables, or restaurants could offer healthier menu options.

- Provide social support for healthy behaviors. For example, employers could offer wellness programs encouraging employees to exercise and eat healthily.

- Use technology to track and motivate healthy behaviors. For example, several apps and wearable devices can help people track their fitness and dietary habits.

- Savings:

- Automate savings. For example, employers could automatically set aside a portion of each employee’s paycheck for retirement savings.

- Make savings more visible and rewarding. For example, some banks offer savings accounts with progress bars that show users how close they are to reaching their savings goals.

- Offer matching contributions to savings accounts. As mentioned above, this can make saving more attractive, even though the benefits are not immediate.